All Categories

Featured

Table of Contents

Getting rid of representative compensation on indexed annuities enables significantly greater illustrated and real cap rates (though still noticeably lower than the cap prices for IUL policies), and no question a no-commission IUL policy would push illustrated and actual cap prices higher also. As an aside, it is still feasible to have an agreement that is really rich in representative settlement have high early cash money abandonment worths.

I will concede that it is at the very least in theory POSSIBLE that there is an IUL plan out there provided 15 or 20 years ago that has actually delivered returns that are superior to WL or UL returns (more on this listed below), however it is necessary to much better understand what a suitable comparison would certainly involve.

These plans commonly have one lever that can be set at the firm's discretion every year either there is a cap rate that defines the maximum crediting price because particular year or there is an engagement rate that defines what percentage of any favorable gain in the index will certainly be passed along to the policy in that specific year.

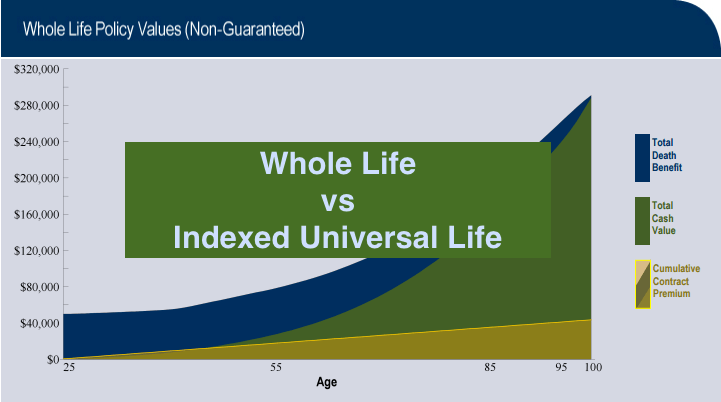

And while I generally concur with that characterization based upon the mechanics of the policy, where I take concern with IUL proponents is when they characterize IUL as having remarkable go back to WL - universal life policy vs term. Several IUL supporters take it a step further and point to "historic" information that seems to sustain their insurance claims

First, there are IUL policies in presence that bring more threat, and based on risk/reward principles, those policies should have higher expected and actual returns. (Whether they in fact do is an issue for severe argument but business are using this technique to aid validate greater detailed returns.) For example, some IUL policies "double down" on the hedging method and analyze an additional fee on the plan annually; this charge is after that made use of to enhance the alternatives budget plan; and afterwards in a year when there is a positive market return, the returns are enhanced.

Indexed Death Benefit

Consider this: It is feasible (and in truth most likely) for an IUL policy that averages an attributed price of say 6% over its initial 10 years to still have a total negative price of return during that time as a result of high charges. Many times, I locate that agents or consumers that boast about the efficiency of their IUL policies are confusing the credited rate of return with a return that correctly reflects all of the plan charges.

Next we have Manny's concern. He claims, "My friend has actually been pushing me to get index life insurance coverage and to join her service. It looks like an Online marketing.

Insurance coverage salespersons are not bad individuals. I'm not suggesting that you 'd dislike yourself if you said that. I said I made use of to do it? That's how I have some understanding. I used to market insurance at the beginning of my occupation. When they offer a premium, it's not unusual for the insurance provider to pay them 50%, 80%, even in some cases as high as 100% of your first-year premium.

It's hard to sell because you obtained ta constantly be looking for the following sale and going to locate the next person. It's going to be difficult to locate a whole lot of satisfaction in that.

Allow's speak about equity index annuities. These points are popular whenever the marketplaces remain in an unpredictable period. Below's the catch on these things. There's, initially, they can manage your behavior. You'll have surrender periods, generally 7, 10 years, perhaps even past that. If you can't obtain access to your cash, I know they'll inform you you can take a little percentage.

Minnesota Life Iul

Their abandonment periods are big. That's just how they recognize they can take your money and go fully invested, and it will be all right since you can't obtain back to your cash till, once you're right into 7, 10 years in the future. That's a long-term. No issue what volatility is taking place, they're possibly mosting likely to be great from an efficiency point ofview.

There is no one-size-fits-all when it revives insurance. Getting your life insurance policy plan right takes into consideration a variety of elements. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your busy life, monetary independence can appear like an impossible goal. And retirement might not be leading of mind, due to the fact that it seems until now away.

Pension plan, social safety, and whatever they would certainly handled to conserve. But it's not that very easy today. Fewer employers are offering conventional pension and many companies have actually minimized or discontinued their retirement and your ability to rely only on social safety and security is in question. Even if benefits have not been reduced by the time you retire, social safety alone was never intended to be sufficient to spend for the lifestyle you desire and are worthy of.

Difference Between Whole Life And Iul

/ wp-end-tag > As component of an audio economic strategy, an indexed global life insurance coverage plan can aid

you take on whatever the future brings. Before dedicating to indexed global life insurance, right here are some pros and cons to consider. If you select an excellent indexed universal life insurance coverage strategy, you may see your cash money value grow in worth.

If you can access it at an early stage, it may be useful to factor it into your. Since indexed universal life insurance calls for a specific level of risk, insurer often tend to keep 6. This type of strategy additionally provides. It is still ensured, and you can readjust the face quantity and riders over time7.

If the chosen index doesn't do well, your cash money worth's development will be influenced. Commonly, the insurer has a vested rate of interest in executing far better than the index11. Nonetheless, there is typically a guaranteed minimum rate of interest, so your plan's growth will not drop below a specific percentage12. These are all variables to be taken into consideration when choosing the most effective kind of life insurance policy for you.

Nevertheless, since this kind of plan is extra complicated and has a financial investment part, it can typically include higher premiums than other plans like whole life or term life insurance coverage. If you do not assume indexed universal life insurance policy is right for you, below are some alternatives to think about: Term life insurance policy is a momentary plan that generally offers coverage for 10 to 30 years.

Vul Vs Iul

Indexed global life insurance is a kind of plan that uses a lot more control and versatility, in addition to higher cash value development capacity. While we do not provide indexed global life insurance policy, we can provide you with more information concerning whole and term life insurance policy plans. We advise exploring all your choices and chatting with an Aflac agent to discover the most effective fit for you and your family.

The remainder is added to the money value of the plan after fees are subtracted. While IUL insurance policy might confirm beneficial to some, it's essential to comprehend just how it works prior to purchasing a policy.

Latest Posts

Universal Life Resources

Whole Life Vs Universal Life Chart

Allianz Iul