All Categories

Featured

There is no one-size-fits-all when it revives insurance policy. Obtaining your life insurance policy strategy ideal considers a number of factors. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your hectic life, economic independence can look like an impossible objective. And retired life might not be top of mind, since it seems up until now away.

Pension plan, social safety and security, and whatever they 'd managed to conserve. It's not that easy today. Less employers are supplying traditional pension plans and lots of firms have actually decreased or discontinued their retired life strategies and your ability to depend only on social security is in question. Also if advantages have not been reduced by the time you retire, social security alone was never planned to be sufficient to pay for the way of life you desire and should have.

Currently, that may not be you. And it's important to recognize that indexed universal life has a great deal to use individuals in their 40s, 50s and older ages, as well as people who desire to retire early. We can craft a solution that fits your details scenario. [video: An illustration of a man appears and his wife and child join them.

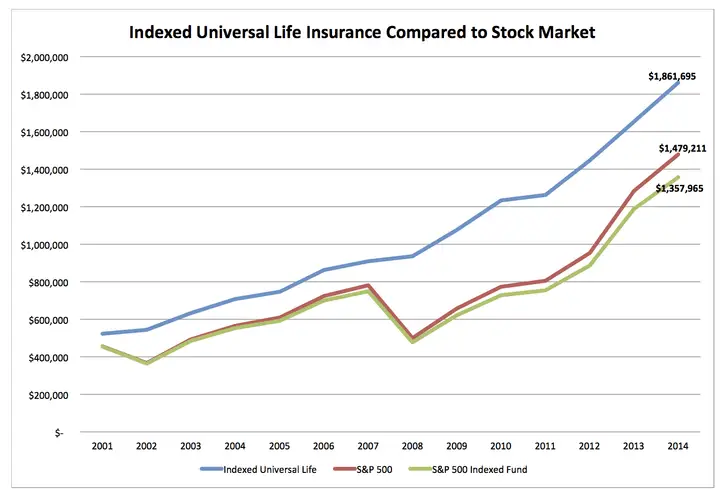

This is replaced by an illustration of a document that reads "IUL POLICY - $400,000". The document hovers along a dotted line passing $6,000 increments as it nears an illustrated bubble labeled "age 70".] Now, mean this 35-year-old male needs life insurance policy to protect his household and a method to supplement his retired life income. By age 90, he'll have obtained almost$900,000 in tax-free income. [video: Text boxes appear that read "$400,000 or more of protection" and "tax-free income through policy loans and withdrawals".] And needs to he pass away around this time, he'll leave his survivors with even more than$400,000 in tax-free life insurance benefits.< map wp-tag-video: Text boxes show up that read"$400,000 or even more of defense"and "tax-free income through policy loans and withdrawals"./ wp-end-tag > Actually, throughout all of the buildup and dispensation years, he'll get:$400,000 or even more of defense for his heirsAnd the opportunity to take tax-free revenue with policy loans and withdrawals You're probably wondering: Exactly how is this possible? And the answer is basic. Passion is tied to the efficiency of an index in the supply market, like the S&P 500. Yet the cash is not straight bought the stock exchange. Interest is credited on a yearly point-to-point sectors. It can offer you extra control, versatility, and options for your financial future. Like numerous people today, you might have accessibility to a 401(k) or various other retirement. And that's a fantastic first step towards saving for your future. It's essential to understand there are limits with qualified strategies, like 401(k)s.

And there are restrictions on when you can access your money without penalties. Charges And when you do take cash out of a qualified strategy, the cash can be taxed to you as income. There's a great factor numerous people are turning to this distinct solution to fix their monetary goals. And you owe it to on your own to see exactly how this can work for your own personal circumstance. As component of a sound financial strategy, an indexed universal life insurance policy policy can help

Cap Life Insurance

you tackle whatever the future brings. And it supplies one-of-a-kind capacity for you to construct considerable cash money value you can utilize as additional earnings when you retire. Your money can expand tax delayed with the years. And when the plan is developed appropriately, circulations and the survivor benefit won't be strained. [video: Text box appears that reads "contact your United of Omaha Life Insurance company agent/producer today".] It is essential to talk to a specialist agent/producer that understands how to structure an option such as this effectively. Before devoting to indexed global life insurance policy, right here are some advantages and disadvantages to take into consideration. If you choose a great indexed global life insurance plan, you may see your cash value expand in value. This is useful due to the fact that you may be able to gain access to this cash prior to the strategy expires.

7702 Iul

If you can access it early, it may be useful to factor it into your. Because indexed universal life insurance policy needs a specific level of risk, insurer tend to maintain 6. This kind of strategy additionally offers (fixed universal life insurance). It is still assured, and you can change the face amount and motorcyclists over time7.

Lastly, if the picked index doesn't do well, your money worth's growth will certainly be affected. Typically, the insurance provider has a vested interest in carrying out much better than the index11. However, there is generally an assured minimum rate of interest price, so your plan's development won't fall listed below a specific percentage12. These are all aspects to be considered when choosing the very best type of life insurance coverage for you.

Variable Universal Life Insurance Reviews

However, considering that this kind of policy is extra complicated and has a financial investment component, it can frequently include greater costs than various other policies like entire life or term life insurance policy. If you do not think indexed global life insurance policy is best for you, right here are some choices to think about: Term life insurance policy is a short-term plan that generally supplies protection for 10 to 30 years.

When deciding whether indexed universal life insurance policy is appropriate for you, it's important to think about all your options. Whole life insurance coverage may be a far better choice if you are looking for even more stability and uniformity. On the other hand, term life insurance policy might be a much better fit if you just need coverage for a specific amount of time. Indexed universal life insurance policy is a kind of plan that supplies a lot more control and adaptability, in addition to higher cash money worth development capacity. While we do not offer indexed universal life insurance coverage, we can supply you with more info about whole and term life insurance policy policies. We recommend checking out all your alternatives and talking with an Aflac representative to find the best fit for you and your family members.

The remainder is added to the cash value of the policy after costs are subtracted. While IUL insurance coverage may show valuable to some, it's crucial to comprehend how it functions before buying a plan.

Latest Posts

Universal Life Resources

Whole Life Vs Universal Life Chart

Allianz Iul