All Categories

Featured

Table of Contents

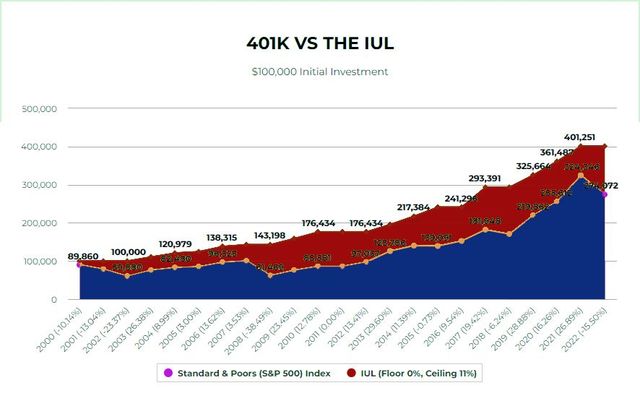

Below is a hypothetical comparison of historical performance of 401(K)/ S&P 500 and IUL. Allow's presume Mr. SP and Mr. IUL both had $100,000 to saved at the end of 1997. Mr. SP invested his 401(K) money in S&P 500 index funds, while Mr. IUL's money was the cash worth in his IUL plan.

IUL's plan is 0 and the cap is 12%. After 15 years, at the end of the 2012, Mr. SP's portfolio expanded to. Because Mr. IUL never ever shed money in the bear market, he would certainly have two times as much in his account Even better for Mr. IUL. Considering that his money was conserved in a life insurance policy policy, he doesn't need to pay tax obligation! Naturally, life insurance policy secures the family members and provides sanctuary, foods, tuition and medical expenditures when the insured dies or is critically ill.

Iul Vs 401k Savings Strategy

The numerous choices can be mind boggling while investigating your retirement spending options. There are particular choices that must not be either/or. Life insurance policy pays a death benefit to your beneficiaries if you need to pass away while the policy holds. If your family members would face economic hardship in case of your death, life insurance coverage uses tranquility of mind.

It's not one of the most rewarding life insurance policy financial investment plans, yet it is one of one of the most safe. A form of permanent life insurance policy, universal life insurance policy enables you to choose just how much of your costs approaches your fatality benefit and just how much goes right into the policy to gather cash money worth.

Furthermore, IULs allow insurance policy holders to secure finances versus their plan's cash value without being strained as income, though unsettled balances may go through taxes and charges. The main benefit of an IUL plan is its possibility for tax-deferred growth. This indicates that any profits within the plan are not exhausted up until they are taken out.

Conversely, an IUL policy might not be one of the most suitable financial savings prepare for some people, and a traditional 401(k) might verify to be a lot more beneficial. Indexed Universal Life Insurance Policy (IUL) plans provide tax-deferred development capacity, protection from market declines, and fatality advantages for recipients. They permit insurance policy holders to earn rate of interest based upon the performance of a stock exchange index while securing versus losses.

Ed Slott Iul Tax Free Retirement

A 401(k) plan is a preferred retired life savings option that permits individuals to spend money pre-tax right into numerous financial investment tools such as mutual funds or ETFs. Companies may also offer matching contributions, better boosting your retired life financial savings capacity. There are two primary kinds of 401(k)s: typical and Roth. With a standard 401(k), you can decrease your taxable income for the year by adding pre-tax dollars from your paycheck, while likewise profiting from tax-deferred development and employer matching payments.

Several employers likewise offer matching payments, successfully providing you cost-free money in the direction of your retirement plan. Roth 401(k)s function similarly to their conventional equivalents but with one key distinction: taxes on payments are paid ahead of time as opposed to upon withdrawal throughout retired life years (IUL vs 401k retirement planning). This means that if you expect to be in a greater tax brace throughout retirement, adding to a Roth account could save on taxes over time compared to spending only via standard accounts (resource)

With lower monitoring fees usually compared to IULs, these kinds of accounts allow investors to save cash over the lengthy term while still taking advantage of tax-deferred development potential. Furthermore, numerous popular low-priced index funds are readily available within these account types. Taking circulations prior to reaching age 59 from either an IUL plan's cash value via loans or withdrawals from a traditional 401(k) strategy can cause adverse tax obligation effects otherwise taken care of thoroughly: While obtaining against your plan's money worth is typically taken into consideration tax-free as much as the quantity paid in costs, any unsettled funding balance at the time of fatality or policy surrender might undergo revenue taxes and fines.

Transamerica Financial Foundation Iul Reviews

A 401(k) offers pre-tax financial investments, employer matching contributions, and potentially even more financial investment options. The disadvantages of an IUL consist of greater management expenses contrasted to standard retirement accounts, constraints in investment choices due to policy limitations, and prospective caps on returns throughout strong market performances.

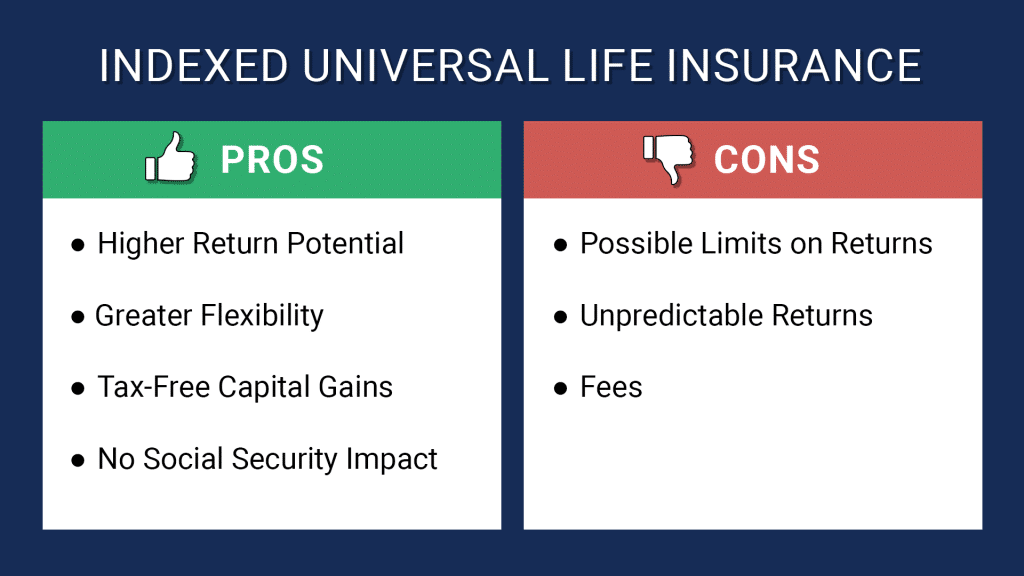

While IUL insurance may show valuable to some, it is very important to understand exactly how it functions before purchasing a policy. There are several advantages and disadvantages in comparison to various other types of life insurance coverage. Indexed global life (IUL) insurance plan give better upside prospective, adaptability, and tax-free gains. This type of life insurance policy supplies long-term insurance coverage as long as premiums are paid.

companies by market capitalization. As the index relocates up or down, so does the rate of return on the cash money worth component of your plan. The insurance provider that provides the plan may provide a minimum guaranteed rate of return. There might likewise be a top restriction or rate cap on returns.

Economists frequently recommend having life insurance policy coverage that's equivalent to 10 to 15 times your yearly revenue. There are numerous drawbacks connected with IUL insurance plan that movie critics are fast to mention. For circumstances, someone that establishes the plan over a time when the marketplace is choking up can finish up with high premium payments that do not add in all to the cash money value.

Apart from that, remember the complying with various other factors to consider: Insurer can establish engagement rates for exactly how much of the index return you get yearly. Allow's state the policy has a 70% engagement price. If the index grows by 10%, your cash money worth return would certainly be just 7% (10% x 70%)

On top of that, returns on equity indexes are typically capped at an optimum amount. A plan may state your optimum return is 10% each year, despite just how well the index executes. These limitations can limit the real price of return that's credited toward your account each year, no matter how well the plan's hidden index performs.

Iul Lebanon

IUL plans, on the various other hand, deal returns based on an index and have variable costs over time.

There are several various other sorts of life insurance policy policies, explained listed below. provides a set benefit if the insurance policy holder dies within a set time period, normally in between 10 and three decades. This is one of the most cost effective kinds of life insurance, along with the easiest, though there's no cash worth accumulation.

Iul Retirement

The policy acquires value according to a taken care of schedule, and there are less costs than an IUL plan. However, they do not included the flexibility of readjusting premiums. includes much more versatility than IUL insurance, suggesting that it is also more complicated. A variable plan's money worth may depend upon the efficiency of particular supplies or other protections, and your costs can also change.

Table of Contents

Latest Posts

Universal Life Resources

Whole Life Vs Universal Life Chart

Allianz Iul

More

Latest Posts

Universal Life Resources

Whole Life Vs Universal Life Chart

Allianz Iul